Typically, the IRS adjusts the rates each year due to rising inflation costs.

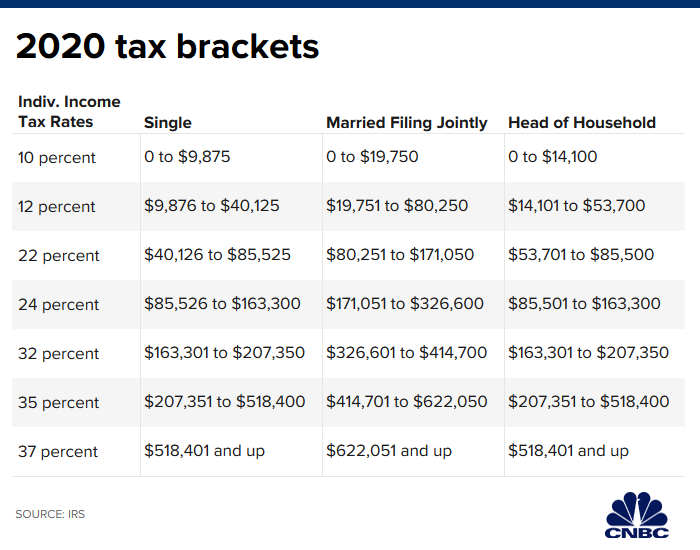

The income tax bracket system, also known as the progressive tax system, is the IRS' attempt to make the American taxation system have the same impact on taxpayers at every income level. One way to get your income to a lower tax bracket is by taking tax credits and deductions.The US follows a progressive tax system with tax brackets adjusted to the level of income.Tax brackets are a set of income ranges that are subject to a set tax rate.On top of income taxes, you’ll also need to pay self-employment taxes, or SECA taxes, to cover Social Security and Medicare taxes. Since you don’t have an employer to withhold taxes from your paycheck, it’s up to you to send estimated tax payments to the Internal Revenue Service (IRS) each quarter. If you’re a freelancer, are self-employed, are part of the gig economy or work as an independent contractor, things are quite different when it comes to US tax rates and tax brackets. Knowing your tax bracket will help you understand how much you’ll pay in taxes on your income. Your employer typically figures out which federal tax bracket you’ll fall into based on your income, and they withhold the corresponding taxes and send them to the IRS. When working as a W-2 employee, you probably don’t spend much time thinking about your tax bracket for the federal tax return.

0 kommentar(er)

0 kommentar(er)